There are payday loans for social assistance that you can apply for in Canada. Keep reading to learn more about payday loans for welfare recipients and key factors to consider before you apply.

Compare payday loans for welfare recipients in Canada

$1,500

|

British Columbia Nova Scotia Ontario Saskatchewan |

In as little as 15 minutes with INTERAC e-Transfer® if approved

|

Varies by province | Apply for your first $300 payday loan at a $20 borrowing cost (excludes Saskatchewan applicants). Residents of Manitoba and New Brunswick cannot apply for a loan online (must apply in-store).

|

$1,500

|

Alberta British Columbia Manitoba New Brunswick Nova Scotia Ontario PEI |

In as little as 2 minutes with INTERAC e-Transfer if approved.

|

Varies by province | Get up to 20% in cash back once your iCASH Payday Loan is fully repaid. Conditions apply. |

$1,500

|

Alberta, British Columbia, Manitoba, New Brunswick, Nova Scotia, Ontario, PEI, Saskatchewan

|

In as little as 2 minutes with INTERAC e-Transfer if approved.

|

Varies by Province |

To apply for a GoDay payday loan, you'll need to be a

Canadian resident over the age of 18 with a valid email address, phone

number and an open bank account with a Canadian bank or credit union.

|

Maximum borrowing costs

You should always refer to your loan agreement for exact repayment amounts and costs as they may vary from our results. The table below shows the maximum allowable cost of borrowing under a payday loan for each province:| Province | Maximum allowable cost of borrowing |

|---|---|

| Alberta | $15 per $100 borrowed |

| British Columbia | $15 per $100 borrowed |

| Manitoba | $17 per $100 borrowed |

| New Brunswick | $15 per $100 borrowed |

| Newfoundland and Labrador | $21 per $100 borrowed |

| Northwest Territories, Nunavut & the Yukon | $60 per $100 borrowed |

| Nova Scotia | $19 per $100 borrowed |

| Ontario | $15 per $100 borrowed |

| Prince Edward Island | $25 per $100 borrowed |

| Quebec | Limit of 35% annual interest rate (AIR) |

| Saskatchewan | $17 per $100 borrowed |

What should I know about payday loans for social assistance?

Lenders view income as an indicator of whether a borrower can afford a loan. Not all lenders recognize welfare or social assistance as a valid form of income, so if you’re looking for payday loans for social assistance, your first step is to find a lender that accepts this income.

Fortunately, payday loans tend to have lenient requirements, so there are many payday lenders in Canada who can accept welfare income. But keep in mind that payday loans are extremely expensive and should only be a last resort. Also, even though you have choices for payday loans as a welfare recipient, not all payday lenders are the same, and the payday loan space overall is notorious for being predatory.

It’s important to choose a lender who abides by provincial regulations and properly assesses your ability to repay a loan.

How to compare payday loans that accept social assistance in Canada

When comparing payday loans as a welfare recipient, ask yourself the following questions.

- What is the reputation of the lender? Check third-party reviews to see what other people have to say about the lender.

- Does the lender abide by provincial regulations? Each province has its own regulations for payday loans, such as maximum borrowing cost, loan terms, rollovers and more.

- How transparent is the lender about fees? The provinces also have rules about how lenders should disclose fees. Look at how the lender breaks down the cost to borrow a payday loan. Payday loans are expensive, and if you look at the borrowing fee as an annual interest rate, the rate is in the triple digits.

- What is the borrowing fee? Depending on your province, the fee can range from $15 to $25 for every $100 borrowed.

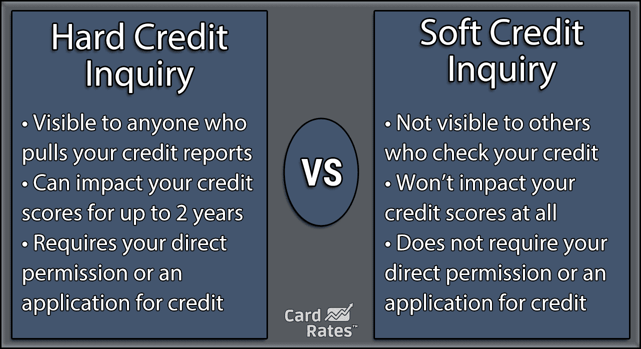

- Does the lender assess your ability to repay? Lenders must make a reasonable judgment on a welfare recipient’s ability to repay the loan. They do so by looking at factors such as your income, living expenses and existing debt. They might also do a credit check. If the lender doesn’t ask you for any of this information, then it is probably not legitimate.

Features of payday loans for social assistance

- Loan amount. Loan amounts are typically between $100 to $1,500, but there are some provinces, such as Ontario and BC, that limit the amount to a percentage of your income.

- Loan term. Loan terms are extremely short. Payday loans must be repaid by your next payday, which is usually within 1 to 4 weeks.

- Borrowing fee. The provinces have maximum borrowing fees. Provinces like Alberta, BC and Ontario have a limit of $15 for every $100 borrowed.

- Bad credit is OK. Having poor credit doesn’t necessarily mean you’ll be denied a payday loan. Payday loans have much more flexible eligibility requirements than other loans.

- Non-employment income is OK. Many payday lenders can accept non-employment income such as government benefits (which include social assistance) and private pensions.

What to watch out for with payday loans for social assistance

With some of the highest interest rates on the market and the tightest turnaround times for loan repayments, welfare recipients in Canada need to be wary of payday loans. While they’re convenient when you’re in a financial bind, here are some things to keep in mind:

- It’s expensive. Not only is the interest rate extremely high, but if you don’t repay your loan on time, you could be penalized with additional fees. Explore all of your financing options before you decide to apply. If you think you might have problems paying the payday loan back on time, avoid getting it in the first place.

- It’s a short-term solution. A short loan term doesn’t give your finances much time to recover. This is why it’s important to be certain that you can repay the loan by your next payday.

- Avoid falling for a payday loan scam. There are many lenders in the online space who prey on people who need money urgently. Be careful when selecting a lender and always do research to find one who is reputable and trustworthy.

How to apply for payday loans as a welfare recipient

While it varies among lenders, you will usually need to supply the following information to apply for payday loans that accept social assistance in Canada:

- Valid ID with your name and address.

- Valid phone number.

- Pay cycle frequency (e.g. bi-weekly or monthly).

- Net and gross amounts of all your income, including your welfare income.

- Proof of income (you can get this by logging into your CRA MyAccount)

- Bank account information where your funds will be transferred (chequing account, routing and institution numbers).

Installment loans if you have benefits in addition to social assistance

If you receive other government benefits regularly to supplement your social assistance, you could be eligible for an installment loan.

32% + brokerage fee |

$500 - $2,500

|

3 - 6 months

|

Currents debts must total less than 60% of income

| Min. credit score: 300 |

Get approved by different lenders in as little as 60

seconds with any credit score. Access resources to help you work toward

better finances.

| ||||

8.00% to 46.96% |

$500 - $50,000

|

3 - 60 months

|

No min. income or employment requirements

| Min. credit score: 300 |

An online broker with the largest lender network in

Canada. Get matched with lenders for free through one quick application

regardless of your financial situation.

| ||||

46.93% |

$500 - $10,000

|

6 - 60 months

|

Stable source of income

| Min. credit score: 560 |

Cash Money offers installment loans up to $10,000

for Alberta, Manitoba and New Brunswick residents. Online installment

loans are available in Alberta only. Residents of Manitoba and New

Brunswick must apply in-store.

|

What is an installment loan?

An installment loan is a type of personal loan with a fixed amount loan that you pay back periodically. Student loans, mortgages and car loans are examples of installment loans because you also repay these with regular amounts over a period of time. There is a key difference though: Most loans that lenders refer to as installment loans are personal loans that come with smaller loan amounts and shorter loan terms than the average personal loan.

Installment loans are usually unsecured and come with a set repayment schedule you’ll iron out with your lender. This way, you’ll know precisely when payments are due and for how much. Term lengths often last between six months and five years.

What to watch out for with installment loans

Installment loans are a convenient way to get the funding that you need, but they come with some drawbacks you need to be aware of. They include:

- Inflexibility with your loan’s terms. Unlike a credit card or line of credit, once you agree with your installment loan’s terms, they’re set in stone. You can’t ask to increase your borrowing limit, change your repayment schedule or amounts or make other adjustments. If you want to change your loan, you may have to get re-approved or pay fees.

- Potential fees. Do your homework to see if the lender charges extra fees, such as prepayment fees and admin fees, before you sign on the dotted line.

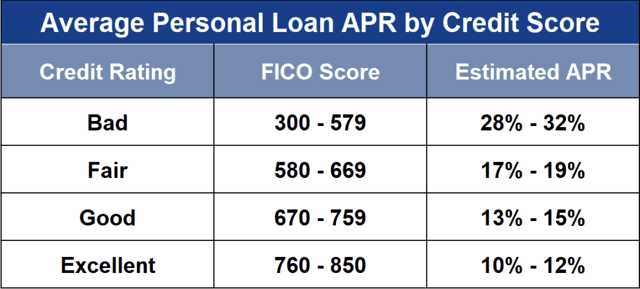

- High interest rates for bad credit. Bad credit could drive up the cost of your loan. This is why it’s important to shop around to get the best interest rate and terms.

Car title loans for welfare recipients

Loans Canada Vehicle Title Loan

|  |

0% to 29.99%

|

$35,000

|

3 - 96 months

|

300

|

Min. income of $1,800 /month, 3+ months employed

|

Get access to financing from multiple lenders across

Canada through a single application with Loans Canada. Bad credit, CERB

and EI borrowers are considered.

|

What is a car title loan?

With an auto title loan,

you put your vehicle up as collateral – meaning if you fail to pay back

your loan, the lender can repossess your car, boat, RV or motorcycle.

For these types of loans, you usually have to outright own your vehicle.

You

can get this type of loan with bad or non-existent credit and income

verification is typically minimal, making this a viable option if you’re

relying solely on welfare. However, auto title loans are extremely

risky since they’re known for their excruciatingly high interest rates

and the precarious nature of your vehicle being repossessed. For

example, interest on a title loan can be as high as 60% per year. It’s

worth noting that lenders can’t charge more than this by law, and that

includes all fees and other costs to get the loan.

What to watch out for with car title loans

If you own your vehicle outright, a car title loan may be a good choice to secure a loan, but you should watch out for these red flags before proceeding:

- Risk of losing your car. With a car title loan, you’re securing your loan with your vehicle as collateral. If you aren’t able to pay back your initial loan plus the interest it accrues, the lender has the right to take possession of your vehicle. Make sure this is a loan your budget can keep up with.

- Steep interest rates. Compared to conventional loans, title car loans come with high interest rates.

- Disreputable lenders. Not all lenders are equally reputable and trustworthy. Compare different lenders in order to find the lowest interest rate and double check your contract before signing, so you understand the ins and outs of your loan including any fees that may crop up.

Other funding options for people receiving benefits

If you’re shopping for a loan as a welfare recipient, you’ll need to find a lender that will accept your weekly, bi-weekly or monthly level of income, as well as your source of income and credit score. Carefully read a lender’s terms and conditions before signing a loan contract, and be willing to walk away if the interest rate or fees are too high.

Here are other possible loan options for you:

- Credit card cash advances. This may be an option if you already have a credit card and haven’t borrowed up to your credit limit. Credit card cash advances have lower rates than payday loans, with APRs usually around 30% – not including additional fees.

- Home equity loans. Are you a homeowner? You may be able to borrow against your home’s equity through a home equity loan or line of credit. This is a secured loan – meaning you use your house as collateral – but it often comes with more lax eligibility criteria than an unsecured personal loan.

- Personal loan via a broker. You can apply with a broker like Loans Canada or LoanConnect, who can match you with a lender that fits your credit and income profile. Once matched, double check with the lender to see if they accept welfare as a source of income. Take note that you may end up getting matched with a lender that offers payday or installment loans. Make sure you can afford repayments before agreeing to any terms.

- You may also have options outside of getting a loan. The Canada Grant Watch website lets you search for grants by category and eligibility requirements. It also provides information on how grants work and how to increase your chance of getting approved. Additionally, people who are under 65 years old and unable to work due to a disability may be able to get benefits through the Canadian Pension Plan (CPP) Disability Benefits program. The exact amount you could receive varies based on your income level and other factors.

Representative example: Jenna buys a wheelchair

Jenna, a resident of Ontario, is recovering from an accident and can’t work for 6 months. To cut down on expenses and pay her bills during this time, she moves in with her mother and applies for government Employment Insurance (EI). Jenna needs a comfortable, lightweight wheelchair to help her get around and finds someone who’s willing to sell her a gently used, high-quality model for $500.

Jenna’s private health insurance coverage is limited and won’t cover the cost, and her annual income puts her over the threshold of qualifying for provincially-funded medical equipment. She’ll have to cover the cost out-of-pocket, but there’s just one problem: The seller wants to close the deal now, and Jenna won’t have the money until her next EI payment arrives in 2 weeks.

Installment loan vs payday loan: Which is better?

Jenna does some online research and finds both a reputable payday lender and installment loan provider. She receives quotes from each based on her credit score, income and other factors. These are the costs:

| Payday loan | Installment loan | |

|---|---|---|

Cost of wheelchair | $500.00 | $500.00 |

Loan amount | $500.00 | $500.00 |

Cost of loan | $15 per $100 borrowed ($75.00 total, includes application fee). This is an interest rate of 391.07% |

|

Loan term | 14 days | 6 months |

Payment amount | One full payment of $575.00 | $91.54 monthly for 6 months |

Total loan cost | $575.00 | $549.24 |

In this case, it’s cheaper for Jenna to get an installment loan to pay for her wheelchair. The fees and interest rate are lower, resulting in an total savings of $25.76. Payday loans are typically much more expensive than most other forms of debt, so this result isn’t surprising.

The final verdict

Besides being cheaper, the installment loan will also allow Jenna to spread out repayment over the next six months, whereas the payday loan will have to be fully repaid in two weeks. Because she’s on a fixed income, Jenna decides the installment loan is the safer and more convenient option.

She applies online, submits the required documentation and is approved instantly, thanks to her solid credit score. The lender sends the funds to Jenna via email money transfer. Within minutes, she receives the money and contacts the seller to finalize the sale. (Note that not all personal loan providers offer instant application decisions.)

*The information in this example, including rates, fees and terms, is provided as a representative transaction. The actual cost of the product may vary depending on the retailer, the product specs and other factors.

Bottom line

Look for lenders that accept government assistance as a form of income. Carefully compare rates and fees, and take the time to understand the terms and conditions of any loan you’re interested in getting.

If approved, you should receive the loan in your bank account within minutes or up to a couple of business days, depending on how the funds are sent. If you apply in person at a payday loan branch, you may be able to leave with cash immediately upon approval.

.jpg)